FRANCE

Offering simple, inclusive and 100% digital home insurance

Nickel is a French fintech that offers basic banking services for anyone, without requirements regarding minimum income, account balance or assets, and with no overdraft authorisation. To meet the needs of its customers - the fintech has reached a total of 4 million accounts in ten years - Nickel needed a comprehensive home insurance solution that is easily accessible, simple to understand and subscribe, and delivers real added value. BNP Paribas Cardif, together with digital insurance company, Lemonade, rose to the challenge and in just six months, shaped an insurance solution and digital customer experience adapted to Nickel customers. This solution is perfectly aligned with Nickel’s positioning and the expectations of its customers, introducing a new vision of insurance.

A custom-tailored solution for Nickel’s clientele

The home insurance developed by Lemonade and BNP Paribas Cardif delivers a fluid and intuitive experience for property owners and renters, at attractive rates with contracts starting at 4 euros per month* for renters. Thanks to a 100% digital process, customers can take out insurance in just minutes via the Nickel application and manage their contracts at any time through Lemonade.

A three-way partnership defined by agility, with key added-value from each partner

This collaboration is built on the complementary expertise contributed by each partner.

Nickel has in-depth knowledge of its customers’ expectations and deploys an agile, digital approach. Lemonade, a leader in online insurance, is widely recognised for its data expertise and innovative solutions. And BNP Paribas Cardif brings its extensive know-how in managing partnerships, as well as in risk management. Combining their expertise, the three players have designed an insurance solution that boasts simplicity, speed and accessibility, perfectly matched to customer expectations.

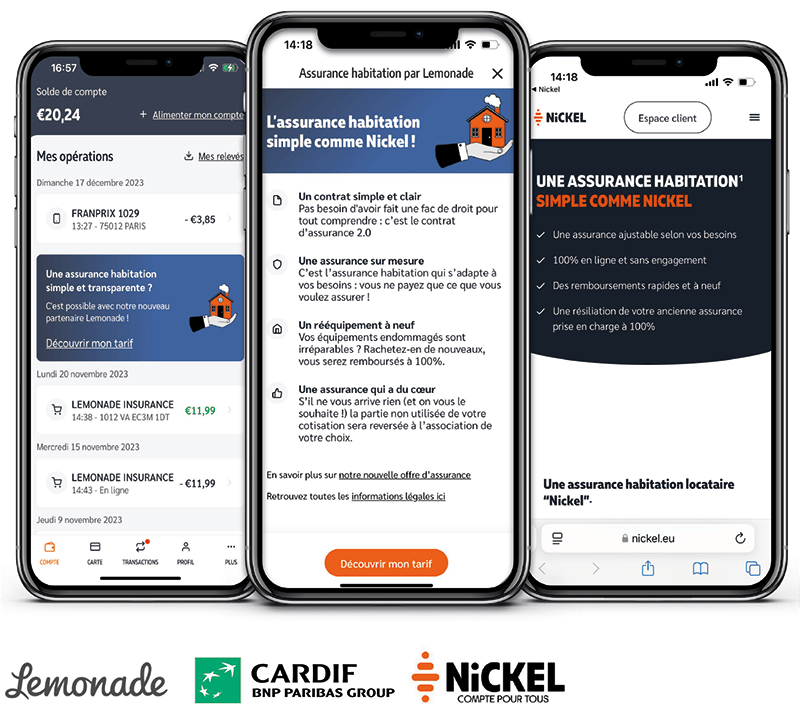

The image shows three screenshots of a mobile interface presenting a home insurance offer available through Nickel, in partnership with Lemonade and the BNP Paribas Cardif Group.

First screen (Nickel app):

A new home insurance offer is directly available within the app, through the Lemonade partner. The user can click to discover their rate. Payments to "LEMONADE INSURANCE" appear in the transaction history.

Second screen (Lemonade offer details):

Presentation of the insurance benefits:

- Simple and clear contract.

- Customized insurance based on individual needs.

- Replacement with new value.

- Option to donate part of the premium to a charity.

Third screen (Nickel website):

Highlights of an easy home insurance offer:

- Adjustable coverage.

- 100% online.

- Fast reimbursements.

- Previous insurance cancellation handled for the user.

“BNP Paribas Cardif brings its extensive know-how in managing partnerships, as well as in risk management.”

Strengthening life insurance execution capabilities for the benefit of partners

Nickel has built its success on a resilient business model and unique customer relationships. Each month, the fintech signs up over 55,000 new customers, 60% of them thanks to word-of-mouth recommendations, a high level of confidence for the banking sector. This partnership heightens Nickel’s attractiveness and drives customer loyalty in a fiercely competitive market. This collaboration also illustrates the ability of BNP Paribas Cardif to anticipate market trends and support digital players as they pursue diversification. The success of the new offer was immediate: just three months after the launch, the new home insurance solutions exceeded sales targets.