Executive Committee

-

Pauline Leclerc-GlorieuxChief Executive Officer

Pauline Leclerc-GlorieuxChief Executive Officer -

Fabrice BagneDeputy Chief Executive Officer, Head of France & Luxembourg

Fabrice BagneDeputy Chief Executive Officer, Head of France & Luxembourg -

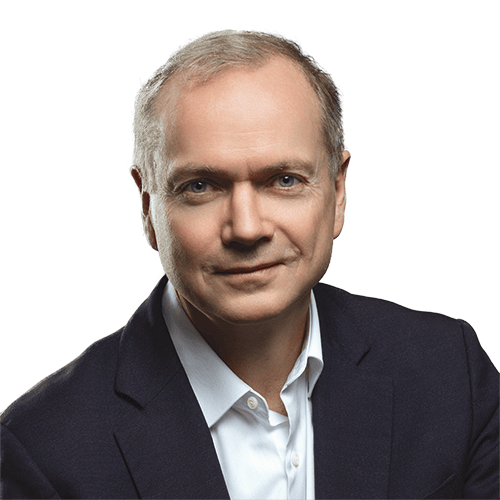

Stanislas ChevaletDeputy Chief Executive Officer, Transformation & Development

Stanislas ChevaletDeputy Chief Executive Officer, Transformation & Development -

Eric MarchandiseDeputy Executive Officer, Finance

Eric MarchandiseDeputy Executive Officer, Finance -

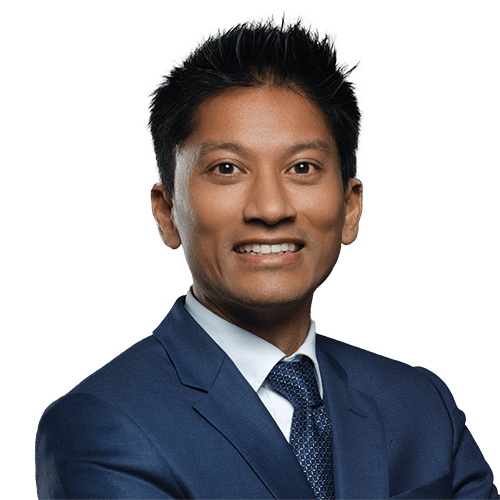

Michael NguyenDeputy Chief Executive Officer, Efficiency, Technology, Operations

Michael NguyenDeputy Chief Executive Officer, Efficiency, Technology, Operations -

Chrystelle RenaudDeputy Chief Executive Officer, General Secretary

Chrystelle RenaudDeputy Chief Executive Officer, General Secretary -

Vivien BerbigierChief Value Proposition Officer

Vivien BerbigierChief Value Proposition Officer -

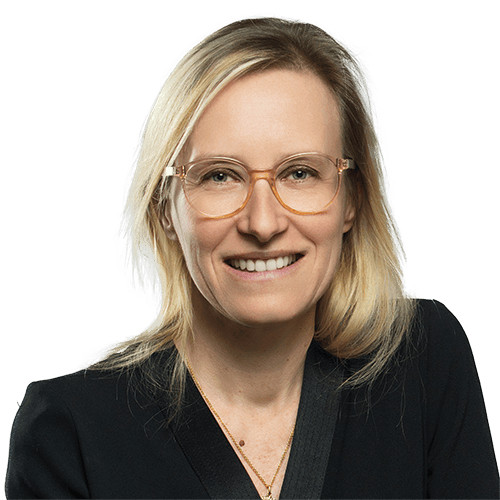

Charlotte ChevalierChief Executive Officer of EMEA (Europe, Middle-East, Africa)

Charlotte ChevalierChief Executive Officer of EMEA (Europe, Middle-East, Africa) -

Alessandro DeodatoChief Executive Officer of Italy

Alessandro DeodatoChief Executive Officer of Italy -

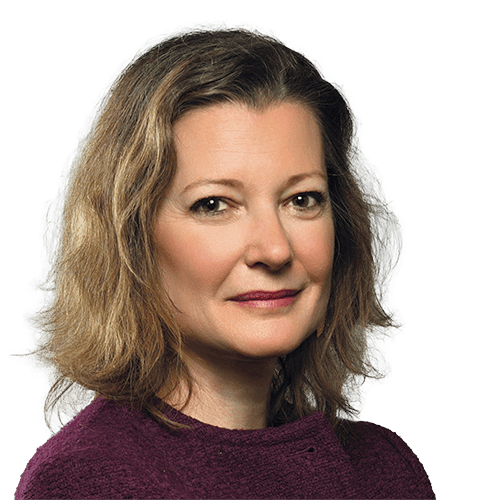

Nathalie DoréChief Impact

Nathalie DoréChief Impact&

Innovation Officer -

Christian GibotChief Financial Actuary, Capital

Christian GibotChief Financial Actuary, Capital&

Modelling Officer -

Anne du ManoirChief Human Resources Officer

Anne du ManoirChief Human Resources Officer -

Christophe MoreauChief Compliance Officer

Christophe MoreauChief Compliance Officer -

See See OoiChief Executive Officer of Asia

See See OoiChief Executive Officer of Asia -

Christelle PaillèsChief Communications Officer

Christelle PaillèsChief Communications Officer -

Murielle Puron ChambordChief Sponsor Key

Murielle Puron ChambordChief Sponsor Key

Project -

Muriel ThibaudChief Risk Officer

Muriel ThibaudChief Risk Officer -

Francisco ValenzuelaChief Executive Officer of Latin America

Francisco ValenzuelaChief Executive Officer of Latin America

Europe

-

Fabrice BagneFrance, Italy, Luxembourg

Fabrice BagneFrance, Italy, Luxembourg -

Åsa BlessnerNordics (Denmark, Norway, Sweden)

Åsa BlessnerNordics (Denmark, Norway, Sweden) -

Christophe De LonguevilleBelgium and the Netherlands

Christophe De LonguevilleBelgium and the Netherlands -

Jean-Christophe DarbesAlgeria

Jean-Christophe DarbesAlgeria -

Alessandro DeodatoItaly

Alessandro DeodatoItaly -

Alexandre DraznieksLuxembourg

Alexandre DraznieksLuxembourg -

Francois Gazel-AnthoineIberia (Spain and Portugal)

Francois Gazel-AnthoineIberia (Spain and Portugal) -

Márk István KissHungary

Márk István KissHungary -

Zdenek JarosCentral Europe

Zdenek JarosCentral Europe

(Austria, Bulgaria,

Czech Republic,

Hungary, Romania,

Slovakia) -

Grzegorz JurczykPoland

Grzegorz JurczykPoland -

Cemal KişmirTurkey

Cemal KişmirTurkey -

Mario KostovBulgaria and Romania

Mario KostovBulgaria and Romania -

Nicolas PoeltlGermany

Nicolas PoeltlGermany -

Oleg RomanenkoUkraine

Oleg RomanenkoUkraine -

Florian WallyAustria

Florian WallyAustria

Latin America

-

Olivier CalandreauMexico

Olivier CalandreauMexico -

Edgar GómezPeru and Colombia

Edgar GómezPeru and Colombia -

Emmanuel PelègeBrazil

Emmanuel PelègeBrazil -

Sebastián ValleChile

Sebastián ValleChile

Asia

-

Sean T. ChuaBNP Paribas Cardif

Sean T. ChuaBNP Paribas Cardif

Assurances Risques Divers

Taiwan (China) -

Laura HuangBNP Paribas Cardif Assurance Vie Taiwan

Laura HuangBNP Paribas Cardif Assurance Vie Taiwan

(China) -

Alfred NaBNP Paribas Cardif TCB Life Insurance Co., Ltd (TCBL) Taiwan (China)

Alfred NaBNP Paribas Cardif TCB Life Insurance Co., Ltd (TCBL) Taiwan (China) -

Nozomu NakamuraJapan

Nozomu NakamuraJapan -

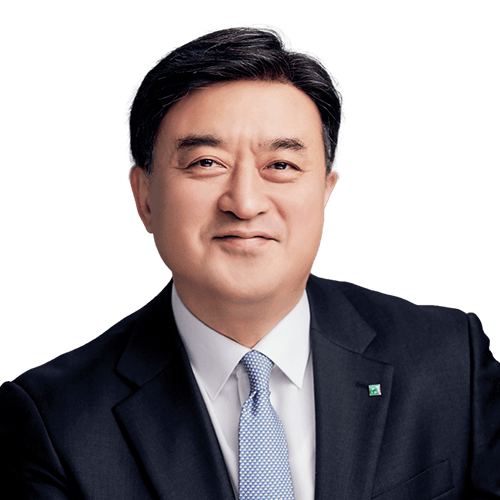

Jonathan OhSouth Korea

Jonathan OhSouth Korea -

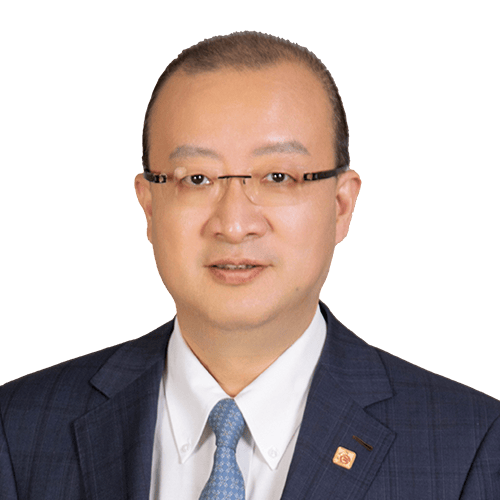

Yongting YangChina

Yongting YangChina

Subsidiaries

-

Baptiste AuffretKarapass

Baptiste AuffretKarapass -

Cyril PetitIcare

Cyril PetitIcare -

Hélène ThillierCardif IARD - France

Hélène ThillierCardif IARD - France