NORDICS

Seamless insurance integration for a fully digital banking experience

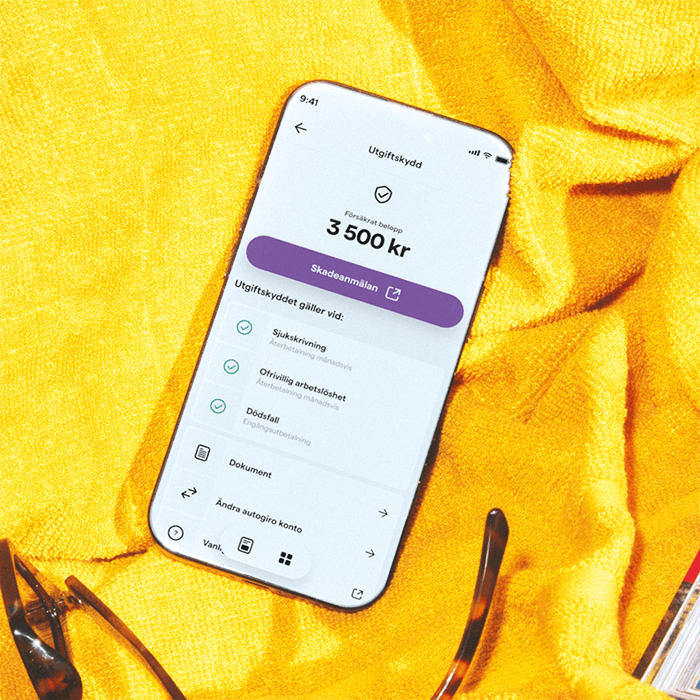

Through its new strategic partnership with BNP Paribas Cardif, Northmill Bank is set to provide fully embedded creditor insurance to its clients, offering protection for personal loans, credits, and budget income protection in Sweden and Finland, starting in 2025. This 100% digital approach aligns seamlessly with the bank’s vision of improving financial life by providing a simplified and personalised banking experience. Built on agility and innovation, this partnership leverages BNP Paribas Cardif’s developed platform and solutions into Northmill Bank’s digital ecosystem, ensuring peace of mind to customers regarding their financial future. This collaboration perfectly complements the ambitious growth strategy of Northmill Bank, one of the fastest-growing digital banks in Europe.

Comprehensive protection for financial stability

This insurance solution covers critical financial risks, including unemployment, illness, hospitalisation, and death, ensuring customers have essential financial security when it matters most.

Enhancing customer loyalty and reducing credit risk

For Northmill Bank, this partnership extends beyond protection; it is a strategic lever to boost customer engagement and mitigate credit risk. By embedding insurance directly into its financial offers, Northmill Bank reinforces its role as a responsible lender by providing its customers with robust safety products with high customer value.

A future-proof partnership to accelerate growth

This collaboration highlights both partners’ agility and innovation capacities, which are essential attributes for fintechs aiming to reshape the banking landscape. Northmill Bank recognised BNP Paribas Cardif’s proven commercial proactivity, expertise in CPI and ability to swiftly launch products on the market.

Both teams worked hand-in-hand to ensure a smooth and efficient roll-out in record time. The first set of products was launched in January 2025, with further extensions already in the pipeline.

The BNP Paribas Cardif +

“With proactive and responsive partnerships, we drive relevant and innovative solutions.”

“For a leading fintech company such as Northmill Bank, embedding insurance had to be seamless, intuitive and fully aligned with their customer experience. That’s exactly what BNP Paribas Cardif delivered, but what set us apart was our ability to act as a full-service partner. Our comprehensive value proposition includes deep expertise, a wealth of experience and capabilities, as well as a keen understanding of our partner’s needs. With our technical solutions and product design, Northmill Bank can offer effortless protection when needed, enhancing customer loyalty while securing their financial stability. We understand that insurance is not always a top development priority for fintechs, which is why we provide ready-to-integrate solutions that accelerate time-to-market. By listening closely and adapting to our partner’s needs, we ensure that our solutions remain relevant and impactful. This partnership is more than just insurance - it’s about delivering real value, enabling Northmill Bank to grow with confidence, and supporting their innovation and speed in a competitive market.”